Nesting, Idling, Thriving

Sometimes y'all get too damn serious... let's play!

We spent the past week and a half in Bozeman, Montana supporting dear friends as they make a major life move to buy a homestead there. You can see Emo and Taco loved it!

Checking in on 2022 Goals

I added a couple new coaching clients while on the trip and have achieved my 2022 goal of billing $10K/month for that business. Rather than fast forwarding to set a 2023 goal, I’ve decided to stop striving around growing Morrill Coaching LLC for a bit and just settle into these new client relationships.

My focus now is on:

Baby making (quite fun!)

Product/Market fit for Firstparty (quite challenging!)

Baseline health (10K steps, 8+ hours of sleep, eating plants)

It’s funny, now that we can conceive I’m feeling a lot less urgency about it. Anyone else have that experience?

I turned 37 a few weeks ago, and I’d be lying if I said I felt the tick of a biological clock. I don’t feel it. I just feel really peaceful in my marriage and home life, and if we add a baby to the mix I know it will be an awesome adventure. And if we don’t, that’s okay too. I will just have to get more dogs.

In terms of other people’s timelines, Kevin just turned 44, and I think he is a little more aware of what it will mean to be an “old Dad” since he had one. He’s fit and healthy as a horse now, but the fact is he will be in his mid-60s by the time our kids graduate high school. There are also my parents, who are in their mid-60s now and hopefully will live for a long long time to come. They just want more grandkids, and who can blame them? Our kids will already be the youngest among 5 other cousins ranging age 14 to 2, and unless my little sister decides to have more I am probably going to be the last one in this generation having kiddos.

Kevin and I are celebrating 15 years of marriage in August, and I feel peaceful.

Nesting Much?

I am excited to share that we bought the house next door to ours in Denver!

We’re working with the original architect and builder of our house (which was constructed in 2005) to turn the lot into a pool, patio, garden, and guest house. I find it calming having our home as our central shared project during all this chaotic market noise, and it makes it easy to be long on all our other investments. I feel fortunate that we found a diversification move that is so life enriching.

Kevin has agreed to take the lead on project management, and I’m sure you’ll see some house updates (and I’m sure some dark humor about budgets and plans and all that) in the coming months. For now, we’re in the queue with the city of Denver for permits and demolition is the next step. I’m thinking about how we can take some brick from the original house and set it aside to build the pizza oven or something else, as small nod to the past.

Market What How Now?

Emotionally, I’m barely noticing the shock waves from the financial markets. Maybe it’s because I never internalized the massive run up of the past few years as real gains? I just updated my “CFO of the household” spreadsheet, and it was pretty wild to plug in a number ~75% lower than in late December for my stock holdings account balance.

As most of you already know, I have two heavily concentrated positions in Twilio and GitLab that come from my time working for these two companies. I’ve come to realize that the way I hold startup stock in my mind is different, and perhaps something that others would benefit from knowing about. I look at it as rainy day upside, not as compensation and not as “real” money until I sell. Even though it is liquid post-IPO I still look at is as an option, and in the case of Twilio where proceeds are QSBS qualified I am even more circumspect. As those who are Super Following me on Twitter know, I’ve been buying more of both.

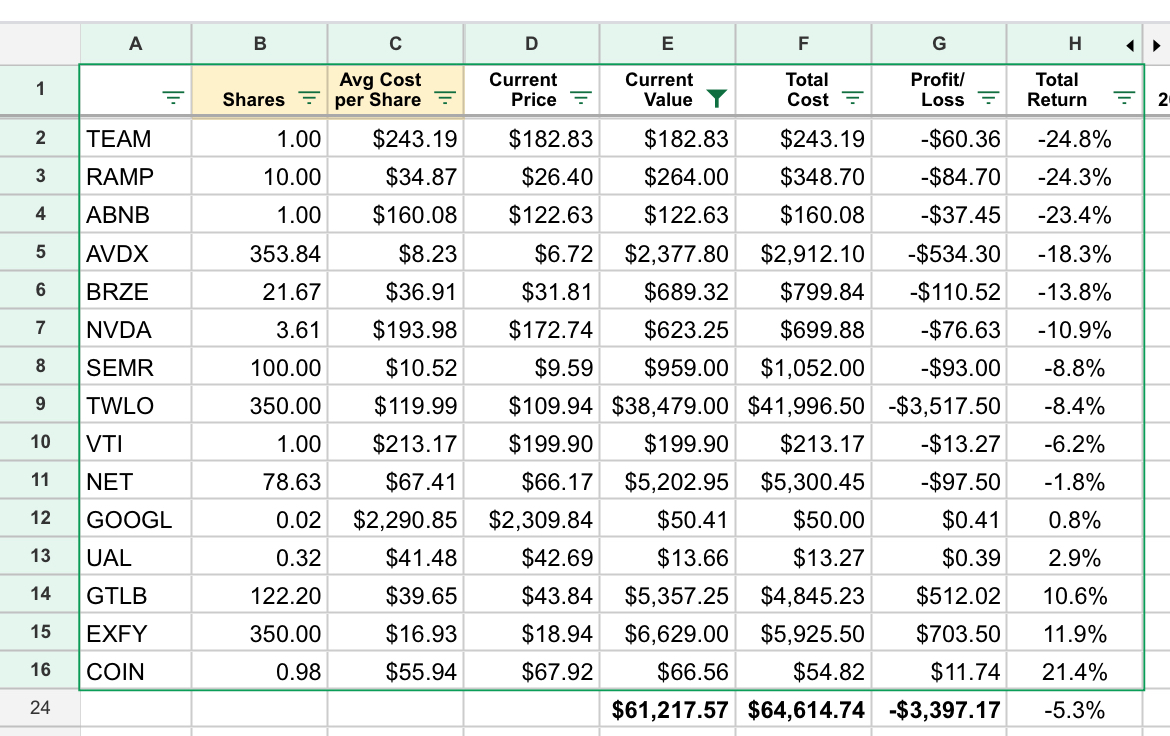

Here’s the latest result of my learning portfolio as of Friday’s close:

Kevin and I drove back to Denver from a visit with friends in Bozeman, Montana on Wednesday and during that 700 mile trek we had to time talk over things a bit re: the market. “I’m thinking through what’s the truly worst case scenario for us,” I told him, “To really be in trouble, we’d have to be fundamentally wrong about software and what it can do for the world.” Obviously there are some other geopolitical SHTF scenarios that are also worst case, but that’s on the downside. On the upside, my theory is that power law value creation in the future will come primarily from psychological goods rather than physical goods (bits vs. atoms).

I see no evidence this is fundamentally breaking. If anything, we are still in the early innings. For those who want to increase their own conviction, I highly recommend reading Future Shock and Revolutionary Wealth by Alvin Toffler

I also “initiated research” (sounds so official doesn’t it?) on a number of companies, which means I bought 1 share and I am planning to read a lot more about them, write up an exec summary, and decide if I want to build a bigger position in the coming months/years:

Thinking Like a Gardener

I’ve been cultivating seedlings since March, and yesterday I started planting them. Of course, I managed to dump a whole tray of marigolds onto the ground and exclaimed reflexively “No, my babies!”

Most of them were fine, and I got them in the ground. Plants are surprisingly resilient, even when they’re tiny. However, this morning I went out to survey how the peppers I put in did overnight, and its clear there are several that have shriveled up and are not going to make it. Experienced gardeners know transplanting is traumatic, and we product more seedlings than we need because we’ll be removing dead plants and subbing in new ones until everything takes.

I feel the sunk cost of the months of cultivating when tossing the tiny plant remains into the compost with a silent Marie Kondo style “thank you”.

I do worry whether there are people suffering in silence, because despite all the bravado to “fail fast” its still quite taboo to be open about losses and failures. When things go badly, the message among the startup and crypto set seems to be caveat emptor. Toughen up kid. I had to take a significant break from Twitter with the most recent crypto swirl, as there is too much grave dancing for my taste.

This weekend, I encourage you all to think about how you can spread the message of long-term thinking, cultivation, and agency. As my friend, investor, and investing partner Chip Hazard shares — thinking like a gardener is called for.

Read the full Twitter thread here.

What I’m Reading Lately

Virtue Hoarder: The Case Against the Professional Management Class by Catherine Liu

The Ruthless Elimination of Hurry by John Ortberg

The Arc by Tory Henwood Hoen

Complexity: The Emerging Science at the Edge of Order and Chaos by M. Mitchell Waldrop

Independent People by Halldor Laxness

Start Where You Are by Pema Chodron

The Ruthless Elimination of Hurry by John Mark Comer

Work Clean by Dan Charnas

The Burnout Society by Byung-Chul Han

I’ve been on a tear with reading, thanks to an incredible deluge of high quality recommendations from my Twitter followers. To get a taste of that they provided in response to my prompts, check out these threads…

As always, I’d love to hear your recommendations on these prompts and anything else you think would tickle my noggin’

Have a great week everyone!

This is a great post! Thanks for sharing your insights. Best of luck to you and Kevin as you work on expanding your family!