Hello from the luscious jungle coast of Mexico, where I’ve been eating so much ceviche, watching polo matches, reading “Future Shock” and working on my health in preparation for starting in on post-retirement parenting.

Consolidating the Active Learning Portfolio

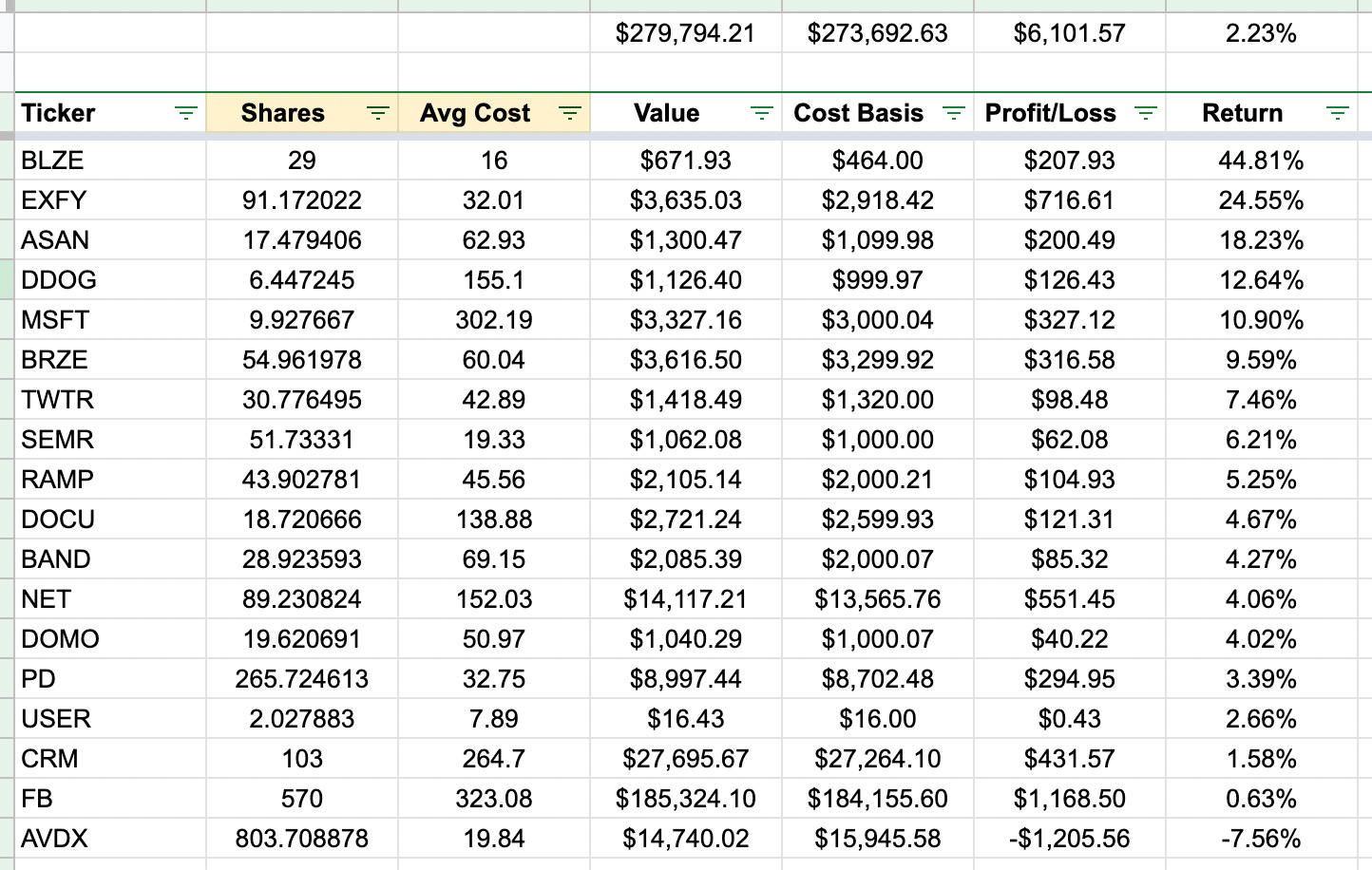

Vacation reading and spreadsheeting has gave me an opportunity to reflect on my positions. I cleaned up all the bets I placed as part of A Ticker A Day, cleared out those that were low conviction, and started a few new positions.

The trend in my portfolio going into the new year continues to be consolidation toward companies who I deeply understand and want to spend time reading about daily, as potential targets for diversification. I’m primarily in B2B SaaS and developer productivity tools, and I am working through writing up a detailed investment memo and position strategies for each.

Bookmark the spreadsheet overview of my active learning positions

My 80/20 Has Shifted

With the IPO of GitLab in October, the balance of my net worth has shifted even more dramatically into two big names:

GTLB (I’m still under the post-IPO employee lockup)

TWLO

After riding the Twilio IPO rollercoaster back in 2016, the volatility around GitLab’s stock has been easier to bear. But it also reminds me how important it is to continue to diversify, and that will be a big focus in 2022.

I won’t be including these two positions in my active investment tracking spreadsheet, but I do look forward to writing about them from time to time and sharing my perspective. These are buy and hold for 10+ years positions for me, and my decision-making process and frequency of re-evaluation is different than for the learning portfolio.

Passive Indexing

As I make a plan to diversify my GTLB position, I’ll take a closer look at fees and income-generation as we move toward less and less W2 income in our household, now that I’ve left my role at GitLab and am not drawing a salary at my new startup (BTW I started cofounded new company!) Firstparty.

Passive index investing has dropped to < 2% of my NW right now with VTI, VTSAX, and whatever Betterment’s robo-advisor selects. I’m hoping this will be a “set it and forget it” area of the portfolio, but I do need to make an allocation decision here, and then deal with the tax consequences.

What’s Next in My Hustles?

Diversification of $GTLB

Increase the enterprise value of Firstparty by getting product-market fit

Grow my coaching practice with new clients and increased rates

Write investment memos for all my learning portfolio companies

Continue investing in early-stage startups and funds

What’s Next in My World?

Becoming a Hudson Certified coach (my final exam is Friday!)

Completing my 100 books reading goal for the year

Applying for my first International Coaching Federation credential

Traveling home to the PNW to see all our extended families for Xmas

Traveling to Hawaii with my parents

Traveling to Jackson w/ Kevin for the Teamshares company trip

Getting pregnant after Kevin reverses his vasectomy

As always, thank you for your patronage as a subscriber to this newsletter. I look forward to continuing to present in-depth analysis of the investments in my active learning portfolio in 2022.