Startup Investment Hits 3.5 Year Low in December, Q1 M&A Slowest Since 1995

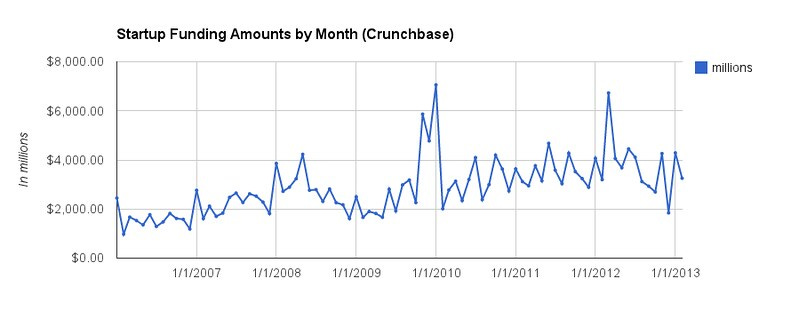

According to investments reported in the Crunchbase database, this winter investment dollars flowing to startup companies reached low point not seen since May 2009.

Even more concerning, on Monday the National Venture Capital Association reported that venture-backed IPO exits fell to a 3 year low in the first quarter of 2013, while M&A was at its lowest point since 1995.

According to the article:

The number of venture-backed IPO exits during the first quarter of 2013 fell 58 percent compared to the first quarter of last year. For the first quarter of 2013, 77 venture-backed M&A deals were reported, 10 of which had an aggregate deal value of $984.3 million, a 73 percent decrease from the first quarter of 2012. This marks the slowest quarter for number of disclosed deals since the first quarter of 1995*, when eight disclosed deals were completed.

"First quarter IPO and acquisitions activity is often subdued as year-end reporting and forward planning take priority, but this year political, taxation, and sequestration concerns weighed even more heavily on the exit market for emerging growth companies. Therefore, activity was especially slow," said John Taylor, head of research for NVCA. "That said, public market valuations have been up recently, 2012 financial statements are being finalized now, and quality companies tell us they are starting the process toward an exit later in the year. Despite having waited for the right opportunity to move forward, the 2013 class of companies that goes public or gets acquired will have to be solid. Barring significantly adverse events, we expect stronger volume in the second and third quarters."

*emphasis added

I'm unclear why the tech press did not report on this, and can only speculate they were too busy curating lists of April Fools Day pranks to notice. Or maybe they thought this was a bad joke from the NVCA?